SBI Car Loan Status

You can track the status of car loan availed from State Bank of India (SBI) online on its official website, visiting the nearest branch of the bank, or by calling the customer care number.

SBI offers car loans at interest rates starting from 8.70% p.a. with a repayment tenure of up to 8 years. Up to 100% of the car's on-road price can be availed as a car loan from SBI.

How to Track SBI Car Loan Status

Whether you apply for an SBI car loan online or offline, you will receive an application reference number. This reference number is necessary to track the status of your SBI car loan application.

With this reference number, you can check the status by any of the below-given ways:

- Online

- Offline

- Calling the customer care helpline

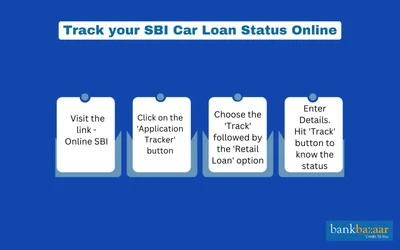

Track your SBI Car Loan Status Online

The online method of tracking the status of your SBI car loan application is convenient, quick, and can be done anytime, anywhere provided you have an internet connection. To track the status of your SBI car loan online, you can follow the below-given instructions:

- Visit the official website of SBI.

- Click on the 'Application Tracker' button present on the top-right hand corner of the page

- Choose the 'Track' followed by the 'Retail Loan' option, enter the application reference number and your mobile number.

- Hit the 'Track' button to know the status of your car loan application.

Track your SBI Car Loan Status Offline

Customers who prefer the human touch can opt for the offline method of tracking the SBI car loan status. This method will require you to walk-in to the nearest branch of SBI and give your loan application reference to the bank officials who will find out the status and reveal it to you.

Track your SBI Car Loan Status by Calling Customer Care

The status of SBI car loan application status can also be tracked by calling SBI's 24/7 toll-free numbers on 1800 11 2211 or 1800 425 3800. These numbers are accessible from all mobile phones and landlines in the country.

Once you call these numbers and provide them with your application reference number, the customer care representatives will let you know your SBI car loan status.

Types of Car Loans Offered by SBI

SBI offers 4 types of car loans and they have been given below:

- SBI New Car Loan Scheme - This loan can be availed by regular employees of state/central/public sector undertaking/private firm/reputed establishment, self-employed professionals/businessmen/partnership firms/proprietary firms, and individuals engaged in agricultural and its related activities.

- SBI Loyalty Car Loan Scheme - This scheme is exclusively for the borrowers of SBI home loan.

- SBI Assured Car Loan Scheme - Under this scheme, there is no minimum income or maximum age limit criteria to avail the loan.

- Certified Pre-Owned Car Loan: Loans are offered for used cars. Up to Rs.150 lakh may be offered as a loan. 85% of the value of the car may be provided as a loan.

- SBI Green Car Loan: Loans are offered for electric cars. The repayment tenure ranges between 3 years and 8 years. 100% of the on-road price of the car may be offered as a loan.

FAQs on SBI Car Loan Status

- Do I have to pay any upfront fee during the SBI car loan application process?

Yes, you are required to pay a processing fee upfront when applying for an SBI car loan. However, SBI occasionally offers special waivers on the processing fee during festive seasons or promotional periods. Check with SBI for the latest offers and updates.

- My credit score is 650. Will it affect the approval of my SBI car loan application?

Under the SBI Car Loan Lite Scheme, you can avail a car loan despite your low credit score. However, you will be charged a slightly higher interest rate. For a credit score falling in the range between 650 and 749, the current interest rate is 12.25% p.a. If you wish to avail SBI car loans at lower interest rates, it is recommended that you maintain a credit score of at least 750.

- How can I know if I am eligible to apply for a car loan from SBI?

You can check your eligibility for SBI car loan and You can also visit the bank's branch to know your eligibility for a car loan.

- Can I do the SBI car loan application process by visiting a branch?

Yes, you can visit any branch of SBI to apply for a car loan. Ensure that you carry the relevant documents when you visit the bank.

- My SBI car loan application got rejected. What could be the reason?

There are multiple reasons as to why your SBI car loan application may be rejected, some of them being poor debt record, lack of steady income, unclear or incorrect information provided, and request for a high loan amount.

- Can I apply for an SBI car loan by visiting a branch?

Yes, you can visit any SBI branch to apply for a car loan. Make sure to bring all the required documents when visiting the bank to facilitate the application process.

- How can I determine if I am eligible to apply for a car loan from SBI?

You can check your eligibility for an SBI car loan online or by visiting the bank's branch. The bank's website may provide tools or calculators to assess your eligibility. Alternatively, you can visit an SBI branch to inquire about your eligibility for a car loan.

- My SBI car loan application got rejected. What could be the reason?

There are several reasons why an SBI car loan application might be rejected. Some common factors include a poor debt record, an inconsistent income source, unclear or incorrect information provided during the application, or a request for a high loan amount that doesn't align with your financial profile.

Car Loan Articles

- Car Prices in India

- How To Transfer a Car Loan to Another Person

- How GST Affected Car Prices in India

- Car Lease Vs Car Loan

- Car Loan Foreclosure Procedure

- Vehicle Registration

- Car Loan Document Checklist

- Bad Credit Car Loan

- Car Loan Refinancing

- Zero Downpayment Car Loan

- Commercial Car Loan

- Car Loan for Nris

- Car Loan Schemes for Women

- Car Loan Preclosure

- Transfer Car Registration

- Top 10 Banks for Car Loan

- Car Loan Schemes for Government Employees

- Fuel Efficient Sedan Cars

- Automatic Cars for Women

- Chepest Cars in India

Disclaimer

Credit Card:

Credit Score:

Personal Loan:

Home Loan:

Fixed Deposit:

Copyright © 2026 BankBazaar.com.